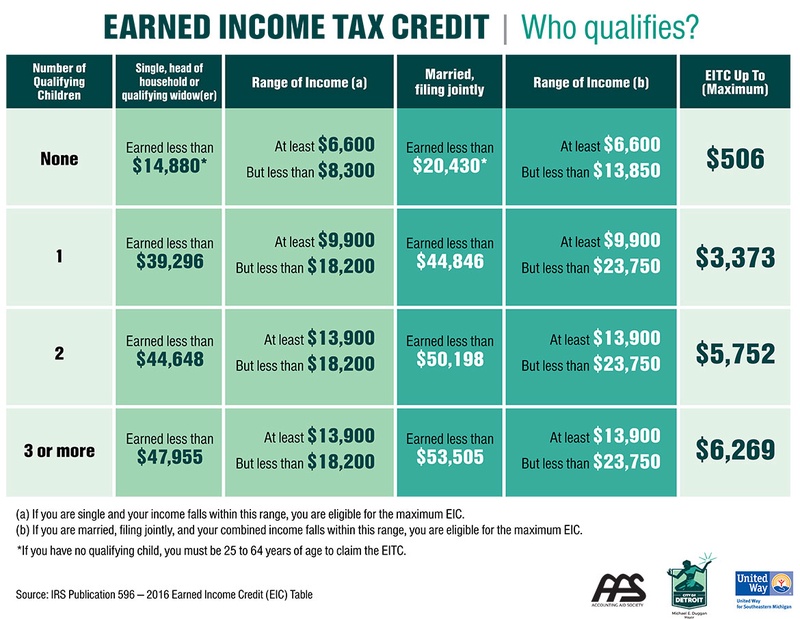

Eic 2025 Chart. To see if you might qualify, use this table to find the maximum credit amounts for tax year 2025 (taxes filed in 2025) and tax year 2025 (taxes filed in 2025) based on your agi. Earned income credit (eic) table 2025 & 2025 or eitc tax table for 2025 & 2025.

Earned income credit (eic) table 2025 & 2025 or eitc tax table for 2025 & 2025. Irs publication 596 details the eligibility rules as well as earned income and agi.

Earned Credit 2025 Tax Table Image to u, 2025 earned income tax credit calculator & table.

2025 Eic Chart Natka Vitoria, You can claim an eic if your adjusted gross income is less than certain limits, depending on whether you file as a single or married couple.

Eic 2025 Helyn Evangelin, Irs publication 596 details the eligibility rules as well as earned income and agi.

How Much Is The Eic For 2025 Farica Fernande, Irs publication 596 details the eligibility rules as well as earned income and agi.

The Ultimate Guide to Help You Calculate the Earned Credit EIC Table, The amounts for the earned income credit can be found in the chart below:

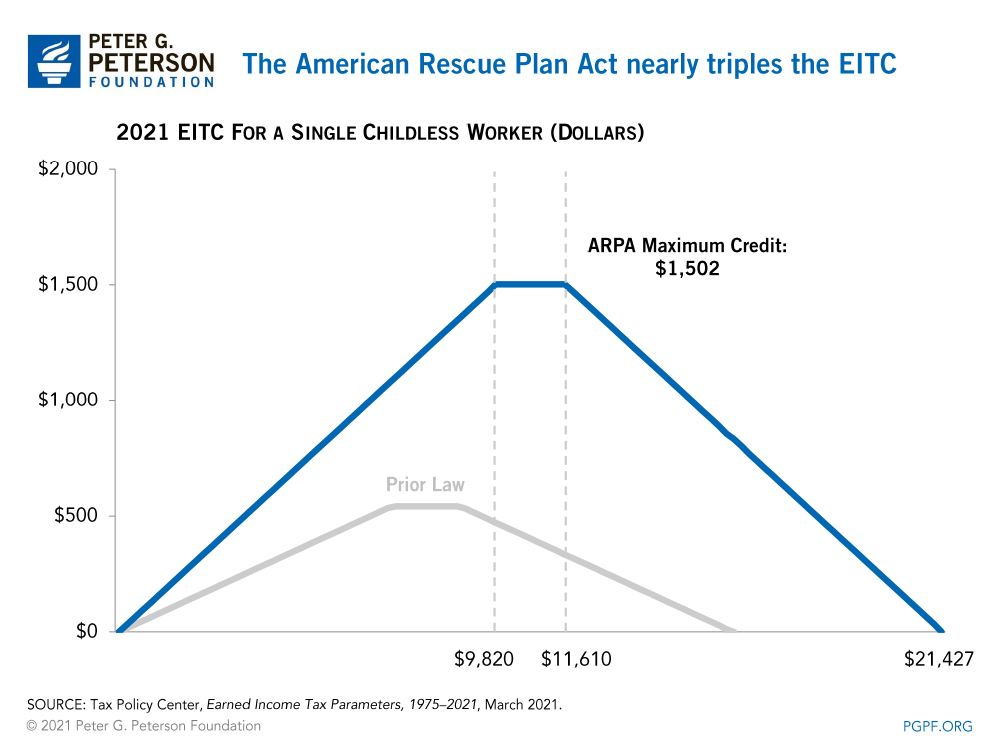

2025 Earned Credit Qualifications Jojo Lexine, The earned income credit will match 50% of the federal credit in 2025.

Earned Tax Table For 2025 Esma Odille, You must consult these tables to find the maximum agi, investment income, and credit amounts for the relevant tax year in which you file a tax return.

Eic 2025 Chart House Ertha Zorine, Earned income credit (eic) table 2025 & 2025 or eitc tax table for 2025 & 2025.

EIC Table 2025, 2025 Internal Revenue Code Simplified, Individuals and families with low to moderate incomes can use the earned income credit (eic) table for 2025 and 2025 to maximize their tax savings.