Mileage Reimbursement For 2025. You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable, business, or moving. $0.67 per mile for driving for business use, a 1.5 cent.

From 1 september 2025, the advisory electric rate for fully electric cars will be 7 pence per mile. Passenger payments — cars and vans.

How Much Is Mileage Reimbursement 2025 Ula Lianna, Approved mileage rates from tax year 2011 to 2012 to present date.

2025 Standard Mileage Rates Released by IRS; Mileage Rate Up, You may provide an allowance or a reimbursement to your employee to compensate for use of their automobile or motor vehicle in connection with or in the course of their office or.

Mileage Reimbursement 2025 Washington State Harri Klarika, Irs issues standard mileage rates for 2025;

2025 Irs Mileage Reimbursement Rate Coral Karola, The irs mileage rate in 2025 is 67 cents per mile for.

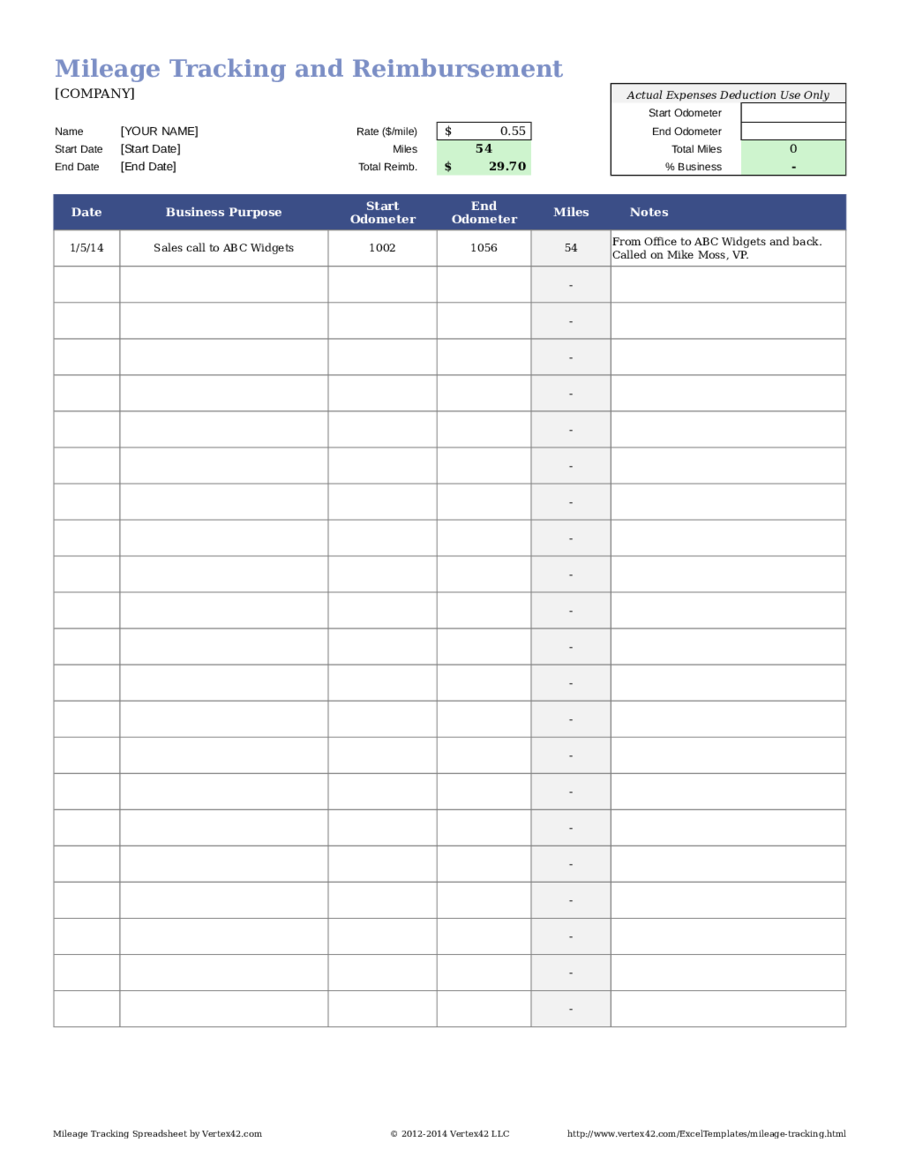

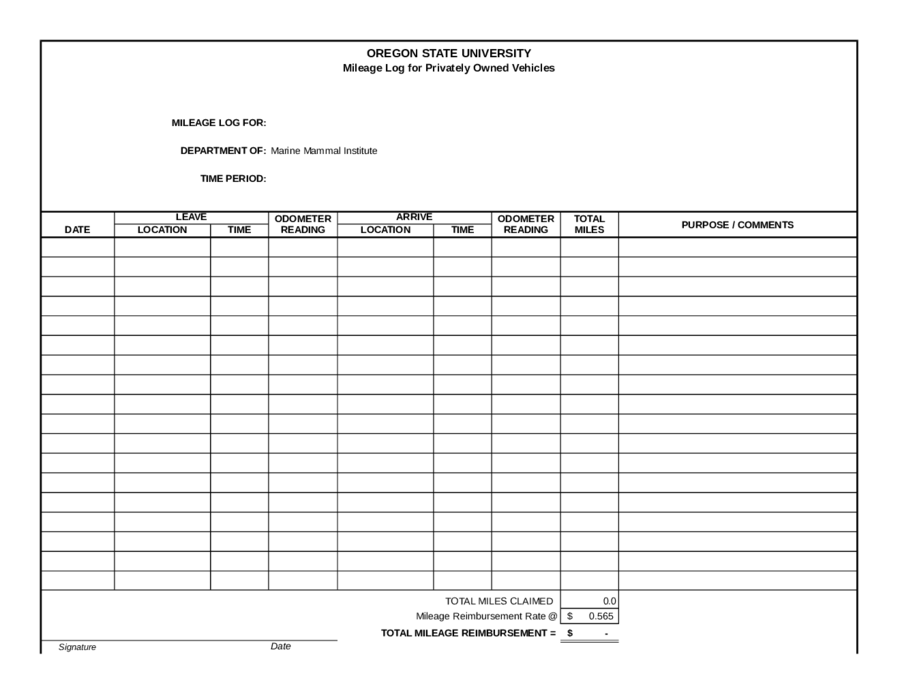

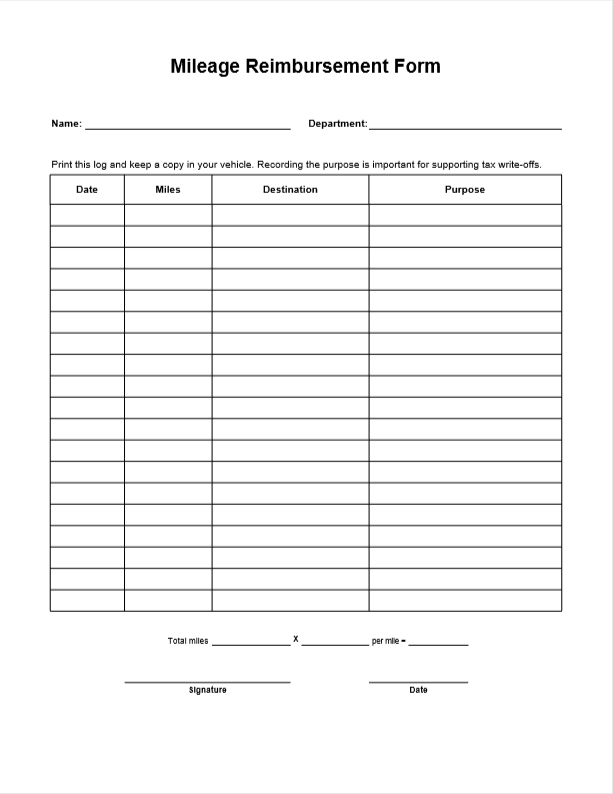

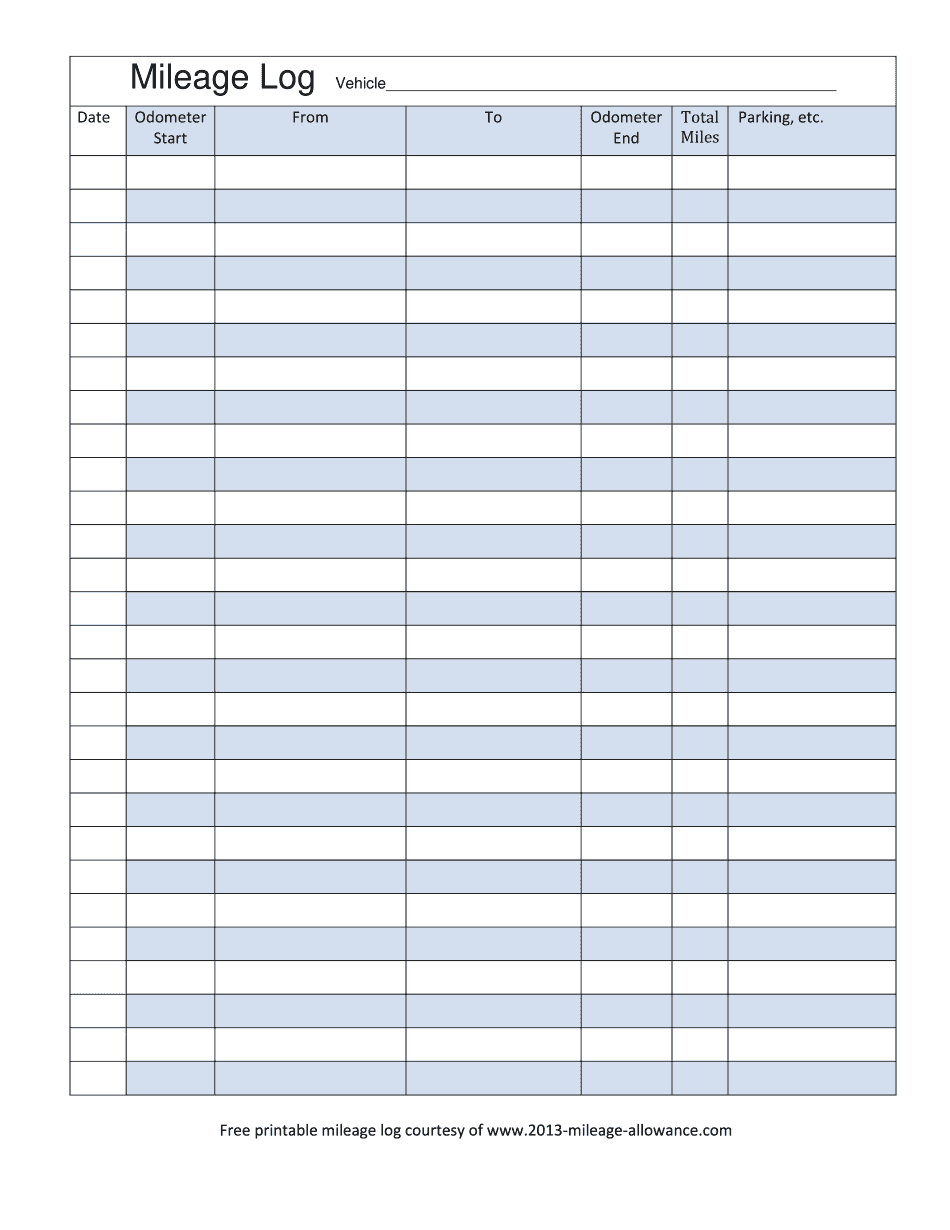

Mileage Allowance Free Printable Mileage Log 2025 Form Printable, There are three categories of travel that are eligible for mileage reimbursement:

IRS Sets Mileage Rate at 67 Cents Per Mile for 2025 CPA Practice Advisor, Starting january 1st, 2025, the irs standard mileage rates are….

Know More about Mileage Reimbursement 2025 Rates ITILITE, Find standard mileage rates to calculate the deduction for using your car for business, charitable,.

2025 Mileage Reimbursement Rate Form Pdf Download Ashlan Lenore, There are three categories of travel that are eligible for mileage reimbursement:

Michigan Medicaid Mileage Reimbursement 20212024 Form Fill Out and, An online travel reimbursement system implemented by the veterans health administration in 2025 has caused headaches for veterans used to filing claims through.